Both Traditional and Roth IRAs can come with potential tax benefits.

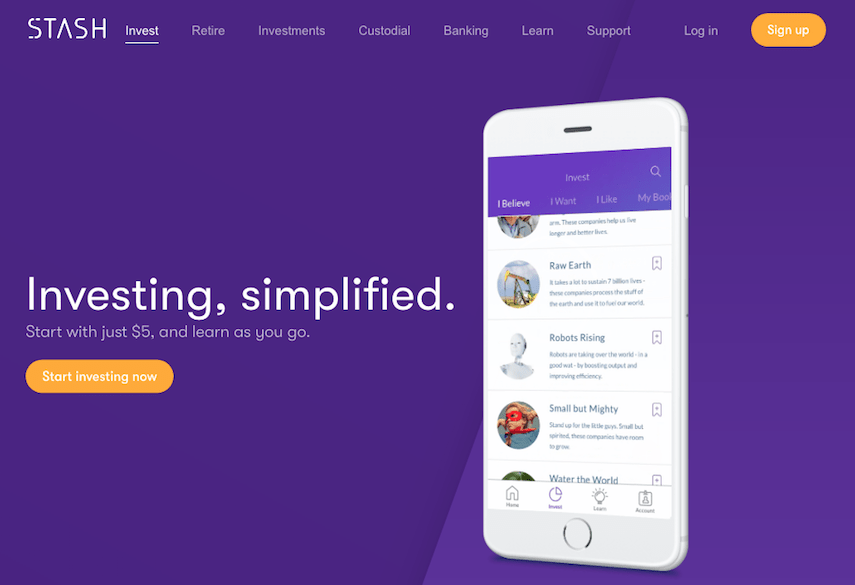

#STASH LOGIN FULL#

To take full advantage of compounding, consider saving for retirement as early as possible. When you invest and earn interest, that interest is added to your principal amount-then, you can start earning interest on the interest. Your savings in an IRA can benefit from compounding, which is a powerful way for your money to grow over time. Future healthcare is a big (and potentially very expensive) unknownĬompounding.We’ll probably receive less in Social Security funds than previous generations.If you plan to stop working at some point in the future, consider these factors. Your retirement can look a lot different than your parents’ retirement. There are many reasons to start saving for retirement as soon as possible.īuild your future. Savvy investors know that saving for retirement can be a great way to build wealth, now and in the future. We’ve put together a guide that can help you decide which account type is right for you.įor additional information on IRAs and contribution limits, you can visit the official IRS website. Should I pick a Roth or Traditional IRA? The type of retirement account you should pick can depend on factors like your current income, your current retirement savings plan, and your projected income in the future. Withdrawals made prior to age 59 ½ are generally subject to income tax and a 10% penalty. However, withdrawals made after age 59 ½ are subject to income tax (but no penalty fee). A Traditional IRA is funded with pre-tax dollars, which can lower your annual tax burden now.

All earnings are tax free at age 59½ or older, assuming your first contribution was more than 5 years prior. Prior to age 59 ½, withdrawals from the interest and/or earnings are subject to income tax and a 10% penalty. Roth IRAs A Roth IRA is funded with post-tax dollars-so after age 59 ½, withdrawals of the money you put in (contributions) are penalty and tax free. Click here for more details.Ī Roth or Traditional IRA is included in every Stash subscription.

#STASH LOGIN VERIFICATION#

In order to obtain personalized investment advice, clients are required to complete the suitability questionnaire during registration, must be approved from an account verification perspective and open a brokerage account. The subscription fee is due if a client is receiving Financial Counseling Services regardless of whether or not a client chooses to open and/or use a brokerage account.

Each plan includes the option to open a brokerage account and a bank account. $10k life insurance offered by Avibra ‡Įach plan includes Financial Counseling services which is impersonal investment advice, as it relates to guides, reports, and education material about investing and financial planning.

0 kommentar(er)

0 kommentar(er)